Depending on the educator and educational material you’ve read on chart patterns, wedge patterns may or may not be considered a triangle pattern. A wedge pattern is considered to be a pattern which is forming at the top or bottom of the trend. It is a type of formation in which trading activities are confined within converging straight lines which form a pattern. This pattern has a rising or falling slant pointing in the same direction. It differs from the triangle in the sense that both boundary lines either slope up or down. Price breaking out point creates another difference from the triangle.

The price action trades higher, however the buyers lose the momentum at one point and the bears take temporary control over the price action. The second phase is when the consolidation phase starts, which takes the price action lower. It’s important to note a difference between a descending channel and falling wedge.

NR4 and NR7 Trading Strategy Setup

One approach is to set a profit target by measuring the distance of the widest part of the pattern and adding it to the breakout of the falling wedge. Then, it can provide a rough estimate of the potential target after the breakout. Another approach is to look for significant resistance levels, such as previous swing highs. On the contrary, a bearish symmetrical triangle is an example of a chart pattern that exhibits a continuation of the downtrend.

- It may take you some time to identify a falling wedge that fulfills all three elements.

- Wedge patterns have converging trend lines that come to an apex with a distinguishable upside or downside slant.

- Wedge patterns are frequently, but not always, trend reversal patterns.

- Since both of these apply to symmetrical triangle patterns, depending on the case, this pattern can show as a bullish or a bearish trend.

- A falling wedge pattern means the end of a price correction and an upside reversal.

- The original definition of the pattern dictates that the slope of both lines should preferably be sloping with the same angle.

In the case of the falling wedge, this usually is a small distance below the wedge. The most important aspect is to place the stop at a level where the market is given room to have its random price swings bounce around, without it impacting hitting the stop too often. The concept of false breakouts isn’t only a concern when it comes to entry triggers, but stop losses placed too close could easily be hit for no apparent reason. In a rising wedge, both boundary lines slant up from left to right. Although both lines point in the same direction, the lower line rises at a steeper angle than the upper one. Prices usually decline after breaking through the lower boundary line.

$42 Per Strategy

However, a good rule of thumb often is to place the stop at a level that signals that the you were wrong, if it. While the most typical way of dealing with a breakout from a falling is to just follow it’s direction, some traders choose another approach. This will help the bullish side along, and will help the bullish breakout take place.

Lastly, in a downturn, a bearish symmetrical triangle must develop, and prices must break through the bottom trend line. One of the continuation chart patterns is the symmetrical triangle https://www.xcritical.com/ pattern, wherein two intersecting trend lines link a set of peaks and troughs to create this pattern. In order to achieve an equal slope, the trend lines should be intersecting.

Is a Rising Wedge Pattern Bullish or Bearish?

One extra clue that a bullish pennant is forming is falling volume as price consolidates. Then, when the market begins to break out of the pattern, volume spikes. Bearish pennants and bullish pennants can indicate that major price action is on the cards – so understanding them is crucial for any technical trader.

A stop-loss order should be placed within the wedge, near the upper line. Any close within the territory of a wedge invalidates the pattern. You can see that in this case the price action pulled back and closed at the falling wedge pattern wedge’s resistance, before eventually continuing higher on the next day. Since both of these apply to symmetrical triangle patterns, depending on the case, this pattern can show as a bullish or a bearish trend.

Identifying it in an uptrend

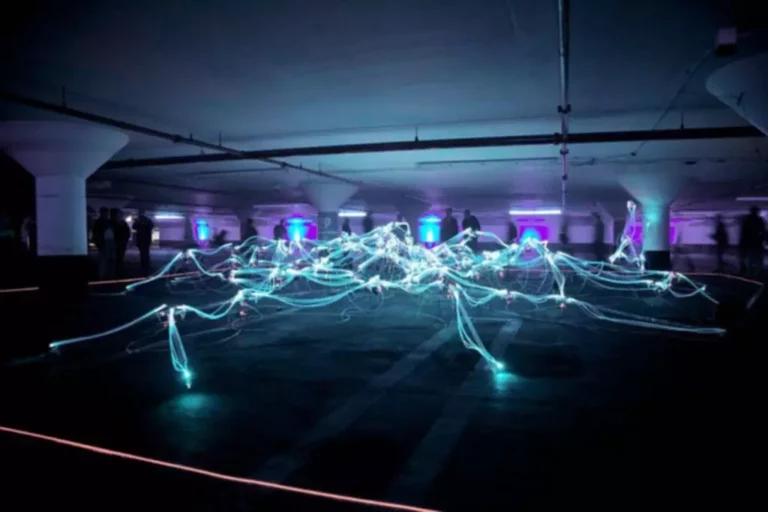

The image below breaks down the pattern to make it easier to get an overview of all the criteria you need to consider. A good upside target would be the height of the wedge formation. As you can see, the price came from a downtrend before consolidating and sketching higher highs and even higher lows. What is most important is that overall pattern respects the general steps mentioned above.

It ultimately make an apex (which is quite far away), but wedges trade very differently than standard triangle patterns. By right approach, we simply mean that you have made sure to validate your methods and approach on historical data, to make sure that they actually have worked in the past. Otherwise you run a huge risk of trading patterns that stand no chance whatsoever. Falling wedges are some of the most popular trading pattern around, and when used in the right manner, they can pinpoint great trading opportunities in the markets.